Finally some good news: a new report shows that foreclosures are down in a huge way. CoreLogic, which offers real estate data, analysis and mapping tools, has unveiled its latest report on foreclosure rates, and indicates that the national level of foreclosures is at a two-decade low.

As of June, 2021, the national foreclosure rate was only 0.2%. The report indicates that this was the tenth month in a row that the foreclosure rate was in decline, a far cry from the Great Recession when millions of Americans lost their homes.

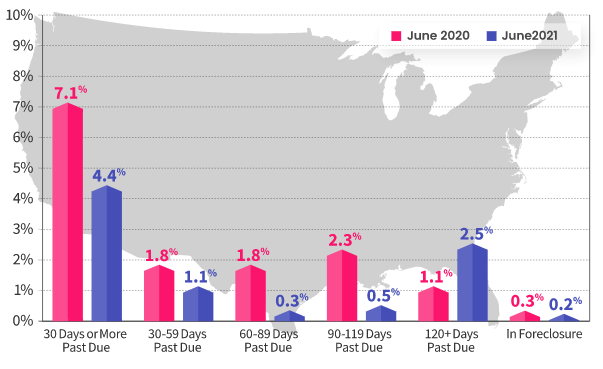

Additionally, the number of mortgages that were delinquent by at least 30 days dropped year-over-year as well. The national delinquency rate fell from 7.1% in June 2020 to 4.4% in 2021, signaling that many homeowners who were struggling last summer have had time and the ability to either get caught up or work out a forbearance or deferral agreement.

While the numbers are positive and signal that homeowners have largely weathered the pandemic, the report does credit the series of ongoing national moratoriums on foreclosures that prioritized housing stability. Additionally, the sweeping CARES Act, which expanded unemployment benefits and offered loans to business owners, also allowed for homeowner to take advantage of a forbearance arrangement without penalty.

However, there are still many homeowners across the country who fall under the “serious delinquency” category, which are mortgages that are more than 90 days past due. Nationally, the overall rate of loans that were seriously delinquent was 3% in June. The figure had improved slightly from the 3.4% during the same period in the prior year.

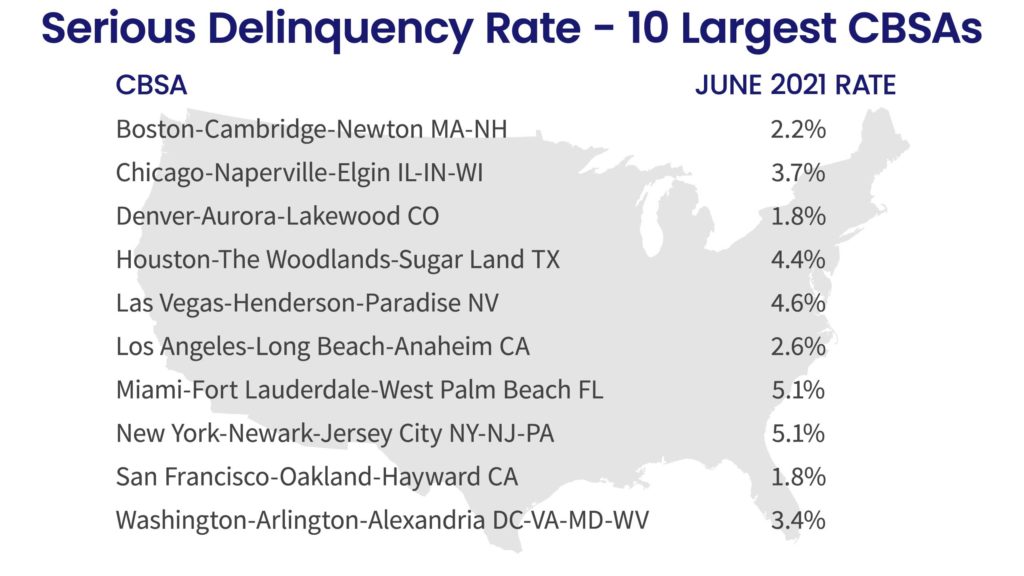

When looking at regional rates, the story gets a little cloudier. Some metro areas are witnessing much higher levels of seriously delinquent loans, such as Miami and New York, which are both at 5.1%. Areas like Boston and Los Angeles were under 3%, but Denver and San Francisco were witnessing even lower numbers of distressed loans, with only 1.8% of serious delinquent mortgages.

The Chicago area seems to fall in the middle of the pack where the June 2021 rate of seriously delinquent mortgages stood at 3.7%. This covers the entire “Chicagoland” region, which includes southeastern Wisconsin and northwest Indiana. Illinois as a whole was not included in the top ten list of states with the highest seriously delinquent rates.

There has been much discussion and reporting on a presumed second foreclosure crisis once all federal, state, and local moratoriums expire, but the series of protections offered by the government, as well as assistance programs through mortgage lenders and servicers, may have provided the necessary time and ability for millions of homeowners to hang on long enough to avoid eviction.